Pricing Models: How To Price Your Product

Updated on September 17, 2025 by Tim Donahue

Considerations When Pricing Your Product or Service

Figuring out how to price a product is more than just doing math. It’s about finding the balance between value, cost, time, and what your customer is willing to pay. Your price needs to support your business—not just cover expenses.

There’s no perfect formula that works for everyone. Some businesses need to account for manufacturing costs. Others spend a ton of time in customer support or onboarding. And if you’re building software or selling online, your costs may be front-loaded, but your long-term time investment can still be heavy.

So, what should you be thinking about before picking a price tag?

- What does it cost you to make or deliver the product?

- How much time does it take you or your team per sale?

- What is the perceived value to the customer?

- How do your competitors price similar products?

- Is your product high-touch or low-touch?

You’ll walk away from this article knowing the major pricing models, when to use each one, how to calculate your price, and what to avoid.

The Main Types of Pricing Models

Every business falls into some kind of pricing structure—whether they think about it or not. Let’s break down the most common pricing models and where they make the most sense.

1. Cost-Plus Pricing

You take your cost and add a markup. Easy to calculate, but doesn’t always reflect what people are willing to pay. Works better in retail or product-based businesses.

2. Value-Based Pricing

You price based on the value your customer sees in the product. Great for unique offers or services where perception matters more than cost.

3. Competitor-Based Pricing

You look at similar businesses and match or adjust accordingly. Just be careful—your costs and quality might not match theirs.

4. Dynamic Pricing

Used in industries like travel or events. Prices shift based on demand, inventory, or timing. Requires tech to track and adjust.

5. Penetration Pricing

You start low to grab attention or market share, then raise prices over time. This can work if you’re launching something new, but be sure you can afford the initial margin hit.

6. Skimming Pricing

You start high, especially if you’re first to market or selling something premium. Prices come down over time as competition enters or costs drop.

There’s no “best” model, just the one that fits how you do business. If you’re just starting out, take a look at this 10-minute guide for new entrepreneurs—it’ll help clarify your overall structure.

How To Choose the Right Pricing Model

The way you price a product depends on more than just what it is. Think about how your business delivers value and what your customer expects.

- Is your product physical, digital, or a service?

Physical products often lean on cost-plus pricing, while digital or SaaS tools are better suited to value-based or tiered models. - Are you in a crowded market?

Competitive pricing might help you get seen, but it can also start a race to the bottom. Use this method with caution. - Do you provide lots of support or custom interaction?

High-touch services should price in your time. That includes onboarding, training, or frequent follow-ups. - How price-sensitive is your audience?

Budget-conscious shoppers might need clear, simple pricing. Premium buyers want proof of value before committing. - What’s your business goal?

If you’re trying to grow fast, lower prices can help—but only if your business can handle the volume. If you need profit now, your price should reflect that.

SaaS businesses and service providers need to pay extra attention here. We’ll cover those in more detail below.

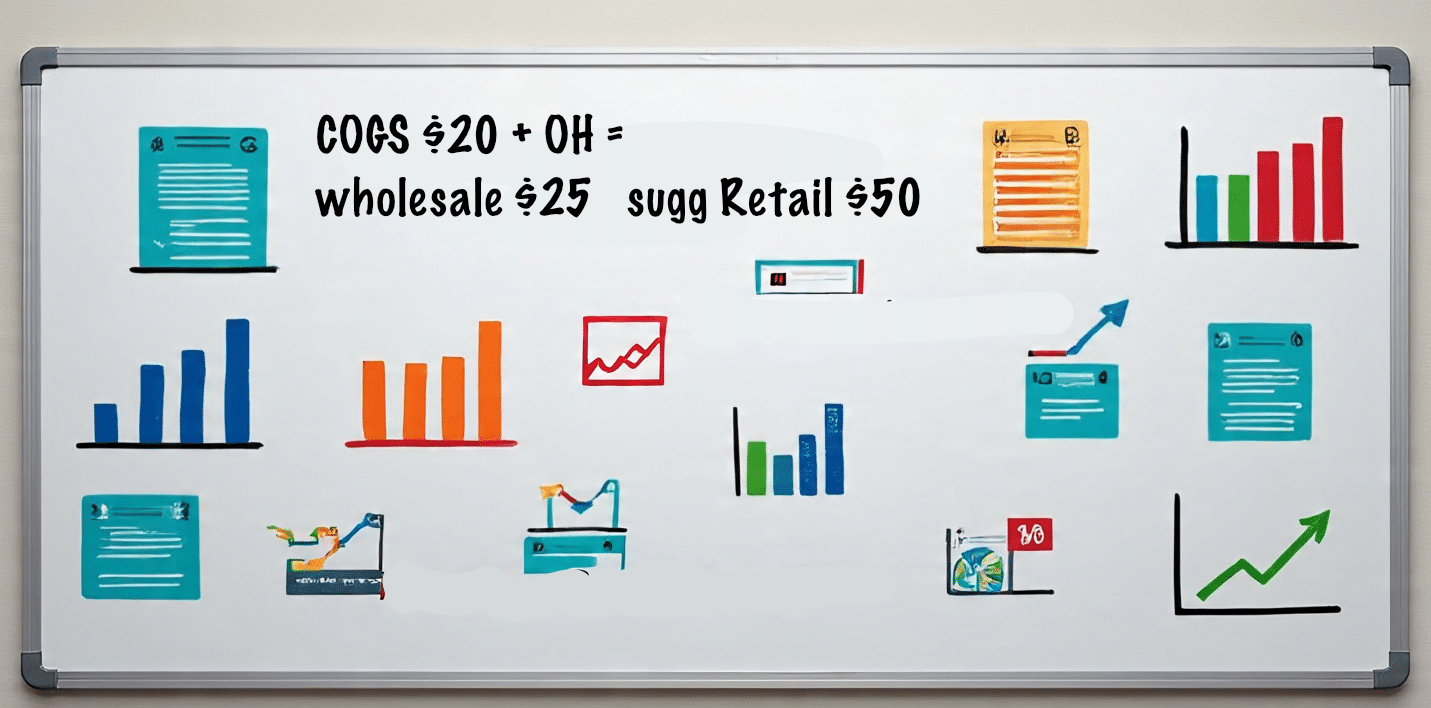

Retail Product Pricing: Step-by-Step

If you’re selling physical products, you need to price in a way that supports both your margin and the retailer’s. That usually means using a wholesale-to-retail model, where you sell your product to a store or distributor at one price, and they sell it to the customer at a higher retail price.

Here’s a simplified step-by-step:

- Calculate your Cost of Goods Sold (COGS) – Include all direct costs: materials, labor, packaging, shipping to your warehouse.

- Factor in overhead – Rent, tools, time, marketing, returns, etc.

- Set your wholesale price – Typically 2× your total cost to ensure profit and sustainability.

- Estimate retail markup – Most retailers use a 100% markup (keystone pricing), meaning they double the wholesale price.

- Test, watch feedback, and stay flexible – Prices may shift depending on demand, positioning, or new costs.

Let’s walk through two real-world examples:

Example 1: Basic Product

– Materials: $5

– Labor & packaging: $3

– Overhead allocation: $2

– Total cost: $10

– Wholesale price: $20 (2× cost)

– Retail price: $40 (100% markup)

You earn $10 profit per unit. The retailer earns $20. Everyone makes money, and the price still fits market expectations.

Example 2: Higher-End Item

– Materials: $12

– Labor: $8

– Overhead allocation: $5

– Total cost: $25

– Wholesale price: $50

– Retail price: $100

In this model, your margin per unit is $25, and the retailer’s is $50. This approach supports scale and leaves room for promotions or discounts without wiping out your profit.

The key is to work backward from the final retail price. You want a price that lets you cover costs, pay yourself, and keep the business growing. For more help setting up early business structure, check out our guide on bootstrapping your startup.

Accounting for Time and Customer Touch

This is where a lot of founders go wrong. They price based on cost, but forget about time. If you’re running a business where each sale requires onboarding, customer education, service, or ongoing communication—those hours add up fast.

Let’s say you sell a $200 course but spend two hours onboarding each customer. That’s not passive income—it’s work. And your pricing has to reflect that.

High-touch businesses need higher margins.

- Include your hourly rate in your cost structure

- Price for support, communication, and maintenance

- Track time per sale to see if you’re really making money

Don’t build a job you hate by undercharging for high-effort work. Want more help thinking through your business structure? Read this article on building a business as an entrepreneur.

Pricing SaaS and Software Products

Software pricing is more complex than just charging a flat monthly fee. Many SaaS companies underestimate the upfront work involved—setup, onboarding, integration, and testing. If you’re doing any custom configuration, hands-on support, or onboarding calls, your pricing should reflect that time and effort.

A smart SaaS pricing model often includes two parts:

- One-time setup or onboarding fee – Covers initial configuration, user training, integrations, or data migration.

- Ongoing monthly (or annual) subscription – For continued access, updates, support, and usage.

This dual pricing approach works well for high-touch tools, B2B services, or platforms that require close client involvement early on.

Here’s an example:

- Setup, onboarding & custom integration: $1,200 one-time fee

- Monthly subscription: $149/month for access, hosting, and support

- Support includes 24/7 ticketing, 2 monthly check-ins, and bug fixes

In this model, the one-time fee helps you recover the heavy upfront time cost, while the monthly fee covers ongoing service and profit.

When planning SaaS pricing, think about:

- How much time your team spends onboarding a client

- How complex the integration is

- Expected customer lifespan (churn matters!)

- Hosting and infrastructure costs

- Customer support volume per account

- Your customer acquisition cost (CAC)

- Monthly churn rate

- Customer support and engineering time

- Infrastructure (servers, APIs, integrations)

Make sure the combined setup + subscription covers all of the above—and leaves profit on top.

Think about the lifetime value of a customer, and make sure your price supports that. You can explore more in our guide on creating a successful ecommerce business—many SaaS fundamentals apply there too.

Examples From the Real World

- Retail: A T-shirt that costs $6 in materials and $4 in overhead (total $10) might be sold wholesale for $20. A retailer could then sell it for $40, using standard 100% markup (known as keystone pricing).

- Service: A freelance consultant charges $100/hour, but must factor admin time, marketing, and client follow-ups. Real rate might need to be $130/hour.

- SaaS: A tool with $5/month server cost per user and $2/month support time might be priced at $20/month to allow for CAC recovery and profit.

These examples show why pricing needs to reflect your full picture—not just what it “costs” at a glance.

Common Pricing Mistakes to Avoid

Here’s where most founders mess up:

- Copying competitors without knowing their costs or model

- Ignoring customer value—what feels cheap to you might feel expensive to someone else, or vice versa

- Not testing pricing over time

- Not building in room for scale—as you grow, costs shift

Need a better grasp of early-stage strategy? This guide on important tips for business owners covers the basics.

Test and Adjust Over Time

You won’t get your price right the first time. And that’s fine.

Keep an eye on:

- Conversion rates before and after price changes

- Customer churn or return rates

- Common objections during sales

Raise your price if customers say it’s “too cheap.” Lower it if no one’s buying and you’re not clearly different. Pricing is fluid—use it to learn.

The right pricing model factors in your costs, customer value, and your time. If one’s missing, you’re guessing.

Final Thoughts

There’s no formula that fits every business. Your pricing has to reflect your product, your market, and your time. Whether you’re building a physical product, a service-based business, or launching a SaaS tool, your pricing model needs to support the business you want to run.

Start with what’s sustainable. Adjust when you learn something new. And always—always—price in your time.

Want more insight? If you’re still working full-time while launching your business, read this guide to starting a business while working full-time.

Published by:

Tim Donahue

StartABusiness.Center

Updated on September 17, 2025