Create a Basic Financial Projection for your Startup

How much revenue is your startup capable of generating?

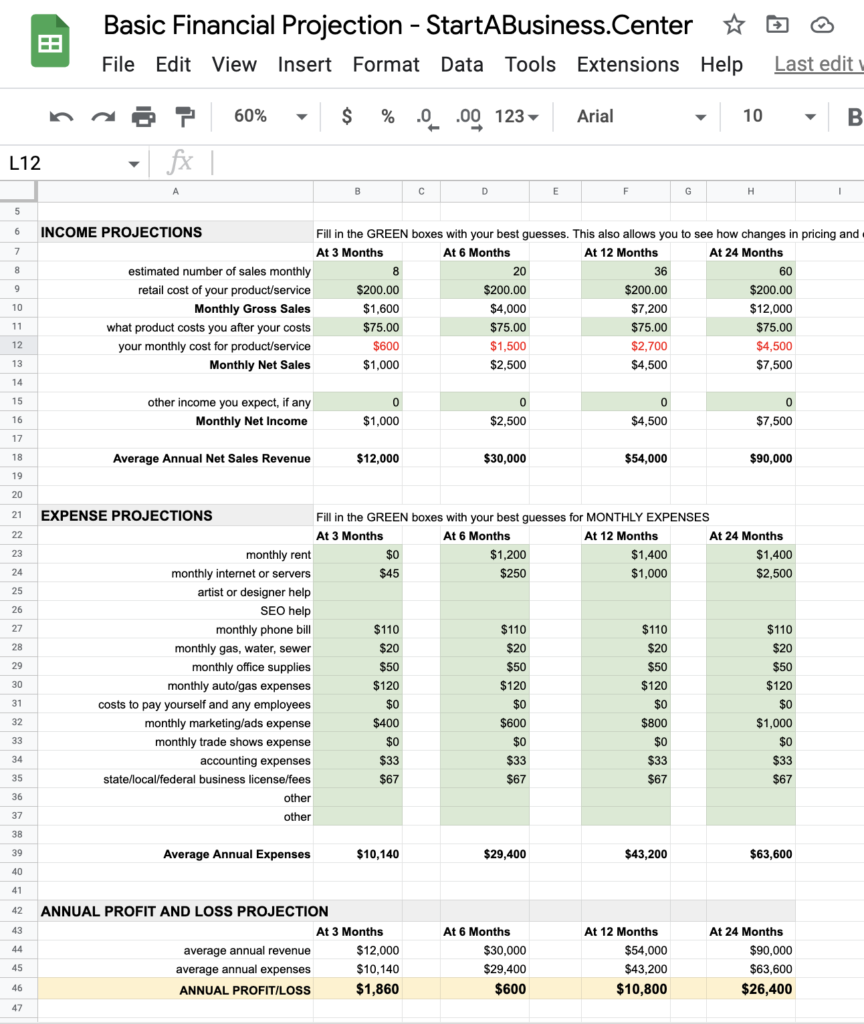

Use this simple template to figure out if your business can generate the money you’re hoping for

We’ve created a simple spreadsheet template – it will give you an idea for how much money your new business idea might be able to generate.

If your new business isn’t capable of generating the kind of revenue you hope for, then it’s better you didn’t build the business. Better to learn now if there are any serious problems with your financial assumptions.

Here’s the template:

https://docs.google.com/spreadsheets/d/16Ror5kgGBLl0ph6h8A26A1hsksvsxJysMUDh2jwlIZs/edit?usp=sharing

Instructions:

- Important >> This copy is read-only, so you need to make a copy for yourself.To do that, choose “File…Make A Copy” in the upper left hand, and save a copy for yourself on Google Drive. Then you will be able to enter your own figures, etc. (or you can download the file and open it and use it.

- In the spreadsheet there are green boxes where you enter your best guesses. Fill in THE GREEN BOXES ONLY. The others will auto-calculate.

Make your best guesstimates for the revenues and expenses.

You can change your guessimates/assumptions and even create a number of scenarios: Conservative, Average and Hopeful.

What if the numbers look amazing?

Time to celebrate.

What if the numbers look awful?

Don’t panic.

The thing you need to do now is see if can reduce expenses, or raise prices, to affect the bottom line and get to a better more favorable number.

Good luck!

Why Financial Projections are a Must-Have for New Entrepreneurs

Risk Assessment

Financial projections allow you to gauge the risks involved in your business venture. By playing with different scenarios, you can understand the level of risk you’re comfortable with and plan accordingly.

Identifying Capital Requirements

Starting a business usually requires some sort of financial investment. By having projections, you can determine the amount of capital needed to start and run your business, and where that capital will come from.

Cash Flow Management

Projections help you anticipate cash flow needs. Knowing when and where your cash will be coming and going can mean the difference between staying afloat and sinking fast.

Strategic Planning

Having a clear financial projection assists in mapping out strategic plans. Whether it’s scaling up or tightening the belt, you’ll know what to do, and when to do it.

Attracting Investors

Investors love data. Detailed financial projections can help you attract potential investors by showing them that you’ve done your homework and are committed to making your business a success.