How To Write a Solid Business Partnership Agreement

Updated on July 5, 2023 by Tim Donahue

Crafting a solid, and flexible Business Partnership Agreement that meets your needs today and in the future

One of the most important things you can do is a founder is to take on a partner in your business. A partner can help shoulder the burden and can help you create synergy as you work together and feed off of each other’s motivation and inspiration.

Crafting a solid, and flexible Business Partnership Agreement that meets your needs today and in the future

One of the most important things you can do is a founder is to take on a partner in your business. A partner can help shoulder the burden and can help you create synergy as you work together and feed off of each other’s motivation and inspiration.

However a partnership can turn sour – and it’s critical to make sure that your partnership agreement gives you a way to dissolve the partnership – or to continue to enjoy it if things are going well.

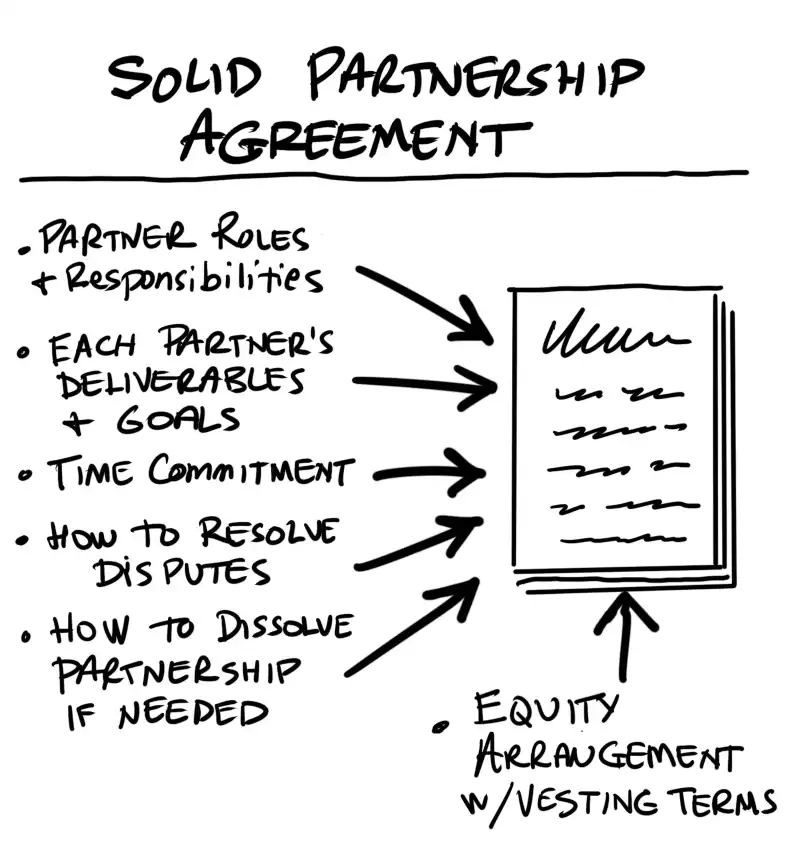

These are the high level steps to crafting a strong and flexible Business Partnership Agreement document:

- Define the roles and responsibilities of each partner

- Determine the ownership percentages and profit sharing

- Establish the decision-making process

- Create a dispute resolution plan

- Outline the process for adding or removing partners

- Establish the procedure for dissolving the partnership

- Include any non-compete clauses or confidentiality agreements

- Consult with legal and financial professionals

- Review and revise the agreement regularly

- Ensure all partners sign and date the document

The Importance of a Solid Business Partnership Agreement

Starting a business partnership is like getting married. You are entering into a serious, long-term commitment with another person. Neither of you would take such a commitment lightly, so why would you enter into a partnership without setting clear expectations and outlining what each person is responsible for?

Creating a solid business partnership agreement is essential to the success of any startup. It’s easy to get caught up in the excitement of starting your own business with someone else, but it’s important to remember that disagreements will arise, and if there’s no agreement in place, it can lead to serious consequences like lawsuits or even the dissolution of the company.

The Benefits of Having a Clear and Comprehensive Agreement

A solid business partnership agreement provides benefits not only when things go wrong but also when things are going well.

By outlining each partner’s responsibilities and obligations, you’ll have clarity about who does what. This clarity can help prevent misunderstandings and ensure that everyone stays on track.

A comprehensive agreement can also help minimize risks and protect your interests. For example, if one partner decides they want out of the partnership or if there is a dispute between partners, the agreement will provide guidance on how to proceed fairly without causing any lasting damage to either party or the company as a whole. In short, creating a solid business partnership agreement helps establish trust between partners and sets expectations for everyone involved in the venture.

It clarifies roles and responsibilities while reducing misunderstandings that can derail even well-intentioned partnerships over time.

Identifying the partners and their roles in the partnership

The first step in creating a solid business partnership agreement is to clearly identify all partners involved in the business.

This includes their names, addresses, and contact information. It’s also important to define each partner’s role in the partnership so that there is no confusion about responsibilities and decision-making authority. This ensures strengths and expertise.

For example, one partner may be more skilled at marketing while another may be better at finance. Defining roles will help avoid conflicts down that the line and ensure that everyone is on the same page.

When starting a business, it’s important to have a clear understanding of the roles and responsibilities of each partner. This will help establish a solid foundation for your partnership and ensure that everyone is on the same page when it comes to their contributions to the business.

To avoid any potential disagreements and keep your partnership strong, consider the following steps:

Define each partner’s role

Start by outlining the specific duties and responsibilities that each partner will have within the business. This should include their areas of expertise, decision-making authority, and any tasks they will be responsible for on a day-to-day basis. For example, one partner may be responsible for managing finances, while another focuses on marketing and sales.

Establish time commitments

When starting a business with a partner and creating a partnership agreement, it’s essential to establish a strong foundation with your partners. One crucial aspect of this foundation is agreeing on the number of hours each partner plans to put into the business weekly. This not only sets clear expectations but also ensures that everyone is on the same page regarding their commitment to the project.

Determining the purpose and goals of the partnership

The next step is to determine what your business partnership is all about. What problem are you trying to solve? What value do you want to bring to your customers? And what are your long-term goals? Once you have a clear understanding of your purpose, you can set specific goals that align with that vision. These goals should be measurable so that you can track progress over time. They should also be realistic and achievable within a reasonable timeframe. By defining your purpose and goals upfront, you can ensure that everyone involved in the partnership is working towards a common vision. This will not only keep everyone motivated but also increase your chances of success as a business.

Business Operations

Decision-Making Frameworks

When forming a business partnership, it’s essential to establish a decision-making framework that works for all parties involved.

One popular approach is the consensus model, where all partners must agree on major decisions affecting the business. This approach has its benefits as it ensures that everyone’s voice is heard, and major decisions are not made without the input and agreement of all partners.

However, this approach can also be challenging when there are multiple partners involved with varying opinions.

Another common model is the majority rules model, where decisions are made by vote. This works well for larger partnerships where it may be challenging to reach a consensus. However, this method can leave some partners feeling left out of important decisions or feeling like their voices aren’t being heard.

Defining Responsibilities and Obligations

Each partner brings unique skills and expertise to the partnership. It’s essential to define each partner’s role and responsibilities within the business clearly.

This includes outlining who will handle day-to-day operations such as managing finances or overseeing marketing efforts. It’s also important to define each partner’s obligations regarding time commitment and investment in the business.

For example, if one partner plans on working full-time in the business while another can only commit part-time hours, that should be outlined in the agreement.

Establishing Financial Rules

When establishing a partnership agreement, it’s crucial to establish clear financial rules that outline how profits will be distributed among partners and how expenses will be handled within the company.

Consider outlining guidelines for distributing profits based on each partner’s contribution or percentage of ownership in the company.

Additionally, establishing clear financial management practices such as bookkeeping routines or hiring an accountant can help ensure transparency regarding financial matters within the partnership agreement.

By outlining these key elements related to business operations within your partnership agreement, you can ensure that everyone involved understands their roles and responsibilities, how decisions will be made, and how finances will be managed. Having a solid framework in place for these foundational elements is critical to the long-term success of your partnership.

Dispute Resolution: How to Solve Conflicts with Your Partner

Starting a business partnership is an exciting adventure, but it can also be stressful at times. As partners, you may have different opinions on how to handle certain situations, which can lead to conflicts. In order to avoid damaging the partnership, it is essential to create a process for resolving disputes.

Creating a Process for Resolving Conflicts

First and foremost, both partners need to agree on the dispute resolution process before any conflict arises.

First and foremost, both partners need to agree on the dispute resolution process before any conflict arises.

This will prevent disagreements from escalating into something more serious and damaging the business relationship.

A good way to start is by discussing potential scenarios that may lead to disputes and agreeing on how they will be handled.

One option is mediation, where an unbiased third party helps both partners reach a mutual agreement without taking sides.

This approach can save both time and money because it avoids litigation fees and court delays. Another option is arbitration, which involves presenting the dispute in front of an arbitrator who makes binding decisions on behalf of both parties.

Discussing Potential Scenarios That May Lead To Disputes

It’s important for partners to anticipate possible scenarios that might cause disputes such as disagreements over financing or decision-making or accusations of breach of contract or fiduciary duty.

By identifying these issues in advance, you can put measures in place that will help prevent them from happening or have plans in place for addressing them quickly if they do occur.

For instance, you could establish clear procedures for making decisions such as requiring unanimous consent on major decisions or setting up a voting system that takes into account each partner’s share in the company.

Creating a fair dispute resolution process not only prevents major issues down the line but also demonstrates your commitment to maintaining healthy working relationships with your partner.

Termination of Partnership

Partnerships can end for various reasons, including disagreements between partners, changes in business goals, or personal issues.

Therefore, it is crucial to have a clear and comprehensive agreement that outlines the conditions for ending the partnership.

Therefore, it is crucial to have a clear and comprehensive agreement that outlines the conditions for ending the partnership.

The first step is to identify the conditions that will lead to termination. For instance, the agreement may state that if one partner violates an essential term of the agreement, such as failing to contribute their share of capital or breaching a non-compete clause, then the partnership will end. Alternatively, the agreement may specify a fixed period during which the partnership will operate and terminate at its expiration.

By outlining these conditions beforehand, both partners understand what constitutes grounds for termination and can plan accordingly.

Detailing how assets will be divided in case of termination

When a partnership ends, it is crucial to have established rules on how assets will be divided between partners. This can include physical assets such as equipment or property owned by the partnership and financial assets such as cash or investments.

One approach could be to divide all assets equally between partners. This method is simple but does not account for individual contributions made by each partner during the life of the partnership.

Alternatively, assets could be divided based on each partner’s contributions or ownership stake in the company. It’s also important to consider liabilities when dividing assets. For example, if there are outstanding debts owed by the business at dissolution time, they should be paid off before any asset distribution takes place.

Having specific rules regarding asset distribution helps prevent conflict and uncertainty when ending a partnership while providing clarity regarding who gets what after dissolution occurs.

Intellectual Property Rights

Establishing Ownership Rights to Intellectual Property Created During the Partnership

When starting a business partnership, it is important to address intellectual property rights upfront. Intellectual property refers to intangible creations such as inventions, designs, and brand names.

Determining ownership of intellectual property becomes especially crucial when the business partnership is dealing with new technology or proprietary information.

First and foremost, partners should identify which party will own any intellectual property that is developed as part of the partnership. This can be done through an intellectual property assignment agreement that stipulates that all intellectual property created during the partnership belongs to one partner or is jointly owned by both partners.

Alternatively, this can be stated in the business partnership agreement itself. It is also important for partners to consider how they will handle disputes related to intellectual property ownership. This may involve setting up a process for resolving conflicts and laying out terms for compensation or royalties if one partner profits from using another partner’s intellectual property without permission.

By addressing these issues early on in the partnership agreement, partners can avoid costly legal battles down the line while protecting their valuable assets.

Confidentiality & Non-Disclosure Agreements

The Importance of Confidentiality

One of the most important aspects of a business partnership agreement is confidentiality. This is especially true if you plan on sharing sensitive information with your partner, like customer lists, trade secrets, or other proprietary information.

Having a non-disclosure agreement in place can help protect your business from the risks associated with sharing confidential information. A non-disclosure agreement (NDA) is a legal contract between two parties that outlines what information can and cannot be shared. It establishes how confidential information will be handled and provides consequences for violating the terms of the agreement.

Having an NDA in place can give both partners peace of mind knowing that their sensitive information is protected.

Creating a Non-Disclosure Agreement

When creating a non-disclosure agreement, it’s essential to include specific details about what kind of information needs to remain confidential. Both parties should agree on what constitutes confidential information and make sure that definition is clearly outlined in the contract.

The NDA should also specify how long the terms of confidentiality will last. Some agreements may only last for a few years, while others may last indefinitely depending on the nature of the partnership. It’s crucial to address any potential consequences if either party violates the terms of the NDA.

This could include monetary damages or even legal action in some cases. Having a non-disclosure agreement in place can give both partners confidence when sharing sensitive information with each other.

By outlining what constitutes confidential information, how long confidentiality lasts, and potential consequences for violating these terms, you can set clear expectations for both parties while protecting your business assets at the same time.

Governing Law & Jurisdiction

When setting up a solid business partnership agreement, it is essential to determine which state laws will govern the agreement and where disputes will be resolved. This section is crucial as it can help to avoid confusion and ensure that all parties involved are aware of the legal implications of any disputes that may arise.

Determining which state laws will govern the agreement

The first step in determining which state laws will govern the partnership agreement is to consider where the partners are located.

The location of each partner can have a significant impact, as different states have different legal requirements and regulations. It’s important to choose a state with favorable business laws that are conducive to your partnership’s needs. Another essential consideration is where the business itself will be located.

For instance, if you plan on running your company in California, you’ll want to make sure that your partnership agreement complies with California’s specific legal requirements.

Where disputes will be resolved

In addition to determining which state laws will govern the partnership agreement, it’s also crucial to decide where disputes between partners will be resolved in case they arise. This decision can significantly impact how easily and quickly any conflict resolution takes place.

One option for dispute resolution is using arbitration or mediation services offered by an independent third party. These services can often provide a faster and less costly alternative than going through traditional court proceedings. Alternatively, you may choose to include a clause in your partnership agreement specifying that any disputes must be resolved within a particular jurisdiction or court system. Whatever method you choose, it is critical that these details are clearly outlined in your partnership agreement so all parties involved understand their rights and obligations under applicable law.

Signatures & Execution

The Devil is in the Details: Finalizing the Agreement

Before signing off on a partnership agreement, it is essential to make sure that all the details have been thoroughly reviewed and agreed upon by all parties involved.

Don’t rush this stage of the process, as there’s no going back once all signatures are on paper. A good way to approach this is by going over each section of the agreement with your partners and discussing any potential concerns or questions that may arise.

Ensure that everyone is on board with the terms laid out in the agreement before moving forward.

Sealing The Deal: Signing and Executing The Agreement

Once you have finalized all details, it’s time to sign and execute your partnership agreement.

There are several ways you can go about doing this, but here are some typical steps:

- Print out multiple copies of the agreement.

- Arrange a meeting where all parties can sign together.

- Each partner should sign each copy of the document in blue ink (to distinguish between original and photocopies).

- Make copies of signed agreements for each party involved.

- Store copies in a safe place where they can be easily accessed if needed.

It’s important to remember that signing an agreement doesn’t mean it’s set in stone forever; you should periodically review your business partnership agreement to ensure it remains relevant and up-to-date with your changing needs and goals as a company.

Conclusion

It cannot be overstated how important it is to have a solid business partnership agreement.

This document serves as the foundation for your business and helps to prevent misunderstandings or disagreements that could lead to costly legal disputes.

By taking the time to create a clear and comprehensive agreement, you can ensure that all parties involved are on the same page and that everyone’s interests are protected.

A well-crafted partnership agreement should cover all aspects of your business, including decision-making processes, financial responsibilities, intellectual property rights, and dispute resolution procedures.

It should also outline conditions for ending the partnership and how assets will be divided in case of termination.

By addressing these issues upfront, you can minimize any potential conflicts down the line.

While creating a solid partnership agreement may seem like a daunting task, it is an investment in the future success of your business.

Remember that this agreement is not set in stone and can be revised as needed.

Open communication between partners is key to ensuring that everyone remains satisfied with the arrangement.

With a strong foundation in place, you can focus on growing your business with confidence knowing that each partner’s interests are protected.

Tim Donahue

StartABusiness.Center

Updated on July 5, 2023